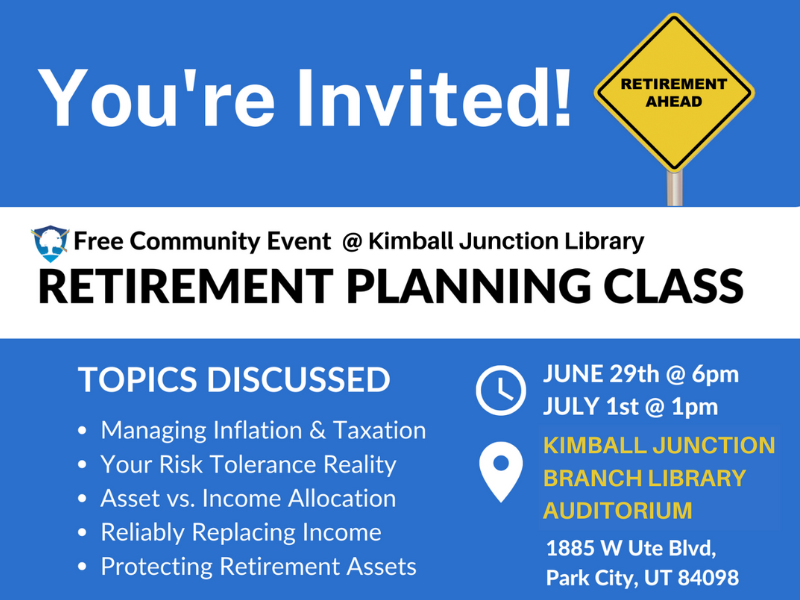

Community Retirement Planning Class

Processing Request

Processing Request

Legacy Retirement MasterClass was created by professionals passionate about educating pre and post retirees. They have spent thousands of hours with retirees on the pleasures and challenges of comprehensive retirement planning that works. This course will teach you important factors and features of an effective plan and is designed for people retiring in the next 15 years or recently retired. This session of the Legacy Retirement MasterClass is delivered in a classroom style format in 2 hours or less and comes with class materials and in class workshops. Seminar and Learning Materials are Free! Register for the class here.

Learn...

-

How to plan for non-taxable Social Security payments.

-

How to integrate Social Security income in your plan with new law.

-

Critical considerations when your savings are in an IRA, 401k, 403b, TSP, 457 or other qualified retirement account.

-

Your options for ‘old’ retirement savings accounts (401’s, IRA’s, etc.)

-

How ROTH conversions and the Tax Cuts and Jobs Act could impact your retirement.

-

Important differences between ROTH vs Traditional IRA accounts.

-

Lessons from the common use of the asset allocation model in retirement planning.

-

How to know if IRMAA or other circumstances impact your Medicare costs.

-

How savings strategies, current and future events may apply to you.

-

What a fiduciary, financial advisor, or financial planner does.

-

How to design a reliable income plan for retirement.

Can't make this event? Another class will be offered on Saturday, July 1st at 1pm.